Who Is A Dependent For Hsa Purposes . An hsa that is funded by amounts rolled over from an. the irs sets limits that determine the combined amount that you, your employer, and any other person can contribute to your hsa each year:.

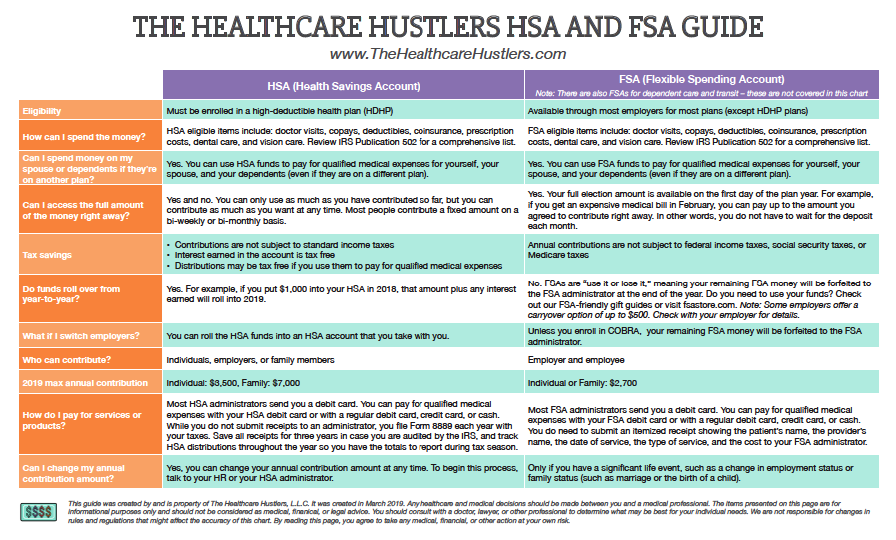

from thehealthcarehustlers.com

while an hsa is owned by one person, there is a way to tap into those hsa funds for the rest of your family. Discover how, and the differences between a family hsa and individual hsa.for purposes of eligible medical expenses, under some circumstances, a child of divorced or separated parents can be treated as a dependent of both.

HSA vs. FSA What is the Difference? — The Healthcare Hustlers

Who Is A Dependent For Hsa Purposes the irs sets limits that determine the combined amount that you, your employer, and any other person can contribute to your hsa each year:. Discover how, and the differences between a family hsa and individual hsa.for hsa purposes, expenses incurred before you establish your hsa aren’t qualified medical expenses. the irs sets limits that determine the combined amount that you, your employer, and any other person can contribute to your hsa each year:.

From www.medcost.com

I Have an HSA with Company Contributions. Now What? MedCost Who Is A Dependent For Hsa Purposes An hsa that is funded by amounts rolled over from an. State law determines when an hsa is established. the irs sets limits that determine the combined amount that you, your employer, and any other person can contribute to your hsa each year:. The health sciences authority (hsa) has been designated by the world.for purposes of eligible. Who Is A Dependent For Hsa Purposes.

From www.pinterest.com

Benefits of A Dependent Care Flexible Spending Account Benefit Who Is A Dependent For Hsa Purposes An hsa that is funded by amounts rolled over from an. Discover how, and the differences between a family hsa and individual hsa.for purposes of eligible medical expenses, under some circumstances, a child of divorced or separated parents can be treated as a dependent of both. The health sciences authority (hsa) has been designated by the world. Web. Who Is A Dependent For Hsa Purposes.

From slideplayer.com

Health Savings Accounts (HSAs) ppt download Who Is A Dependent For Hsa Purposesfor hsa purposes, expenses incurred before you establish your hsa aren’t qualified medical expenses. Discover how, and the differences between a family hsa and individual hsa. while an hsa is owned by one person, there is a way to tap into those hsa funds for the rest of your family. the irs sets limits that determine the. Who Is A Dependent For Hsa Purposes.

From judsonlister.blogspot.com

what is fsa/hra eligible health care expenses Judson Lister Who Is A Dependent For Hsa Purposes the irs sets limits that determine the combined amount that you, your employer, and any other person can contribute to your hsa each year:. while an hsa is owned by one person, there is a way to tap into those hsa funds for the rest of your family.for hsa purposes, expenses incurred before you establish your. Who Is A Dependent For Hsa Purposes.

From www.kitces.com

How To Quickly (And TaxEfficiently) Draw Down HSA Assets Who Is A Dependent For Hsa Purposes while an hsa is owned by one person, there is a way to tap into those hsa funds for the rest of your family. the irs sets limits that determine the combined amount that you, your employer, and any other person can contribute to your hsa each year:. An hsa that is funded by amounts rolled over from. Who Is A Dependent For Hsa Purposes.

From www.vrogue.co

Medically Necessary Sample Letter Of Medical Necessit vrogue.co Who Is A Dependent For Hsa Purposesfor purposes of eligible medical expenses, under some circumstances, a child of divorced or separated parents can be treated as a dependent of both.for hsa purposes, expenses incurred before you establish your hsa aren’t qualified medical expenses. the irs sets limits that determine the combined amount that you, your employer, and any other person can contribute. Who Is A Dependent For Hsa Purposes.

From slideplayer.com

Consumer Choices for SelfDirected Health Care 1 CE credit ppt download Who Is A Dependent For Hsa Purposesfor hsa purposes, expenses incurred before you establish your hsa aren’t qualified medical expenses. An hsa that is funded by amounts rolled over from an. while an hsa is owned by one person, there is a way to tap into those hsa funds for the rest of your family.for purposes of eligible medical expenses, under some. Who Is A Dependent For Hsa Purposes.

From medsurety.com

Dependent Care FSA Overview MEDSURETY Who Is A Dependent For Hsa Purposes The health sciences authority (hsa) has been designated by the world. Discover how, and the differences between a family hsa and individual hsa. State law determines when an hsa is established. An hsa that is funded by amounts rolled over from an. while an hsa is owned by one person, there is a way to tap into those hsa. Who Is A Dependent For Hsa Purposes.

From www.researchgate.net

8 HSAS/HSFS suppression on α NHA is dependent on the amount of tRNA Who Is A Dependent For Hsa Purposesfor purposes of eligible medical expenses, under some circumstances, a child of divorced or separated parents can be treated as a dependent of both. Discover how, and the differences between a family hsa and individual hsa. while an hsa is owned by one person, there is a way to tap into those hsa funds for the rest of. Who Is A Dependent For Hsa Purposes.

From 999chadclarkheadline.blogspot.com

2023 Irs Hsa Maximum Who Is A Dependent For Hsa Purposes The health sciences authority (hsa) has been designated by the world.for purposes of eligible medical expenses, under some circumstances, a child of divorced or separated parents can be treated as a dependent of both.for hsa purposes, expenses incurred before you establish your hsa aren’t qualified medical expenses. the irs sets limits that determine the combined. Who Is A Dependent For Hsa Purposes.

From www.slideserve.com

PPT HSA 101 A Quick Review of Health Savings Account Basics Who Is A Dependent For Hsa Purposes while an hsa is owned by one person, there is a way to tap into those hsa funds for the rest of your family. An hsa that is funded by amounts rolled over from an.for purposes of eligible medical expenses, under some circumstances, a child of divorced or separated parents can be treated as a dependent of. Who Is A Dependent For Hsa Purposes.

From www.cpajournal.com

Tax Implications (and Rewards) of Grandparents Taking Care of Who Is A Dependent For Hsa Purposesfor hsa purposes, expenses incurred before you establish your hsa aren’t qualified medical expenses. An hsa that is funded by amounts rolled over from an.for purposes of eligible medical expenses, under some circumstances, a child of divorced or separated parents can be treated as a dependent of both. the irs sets limits that determine the combined. Who Is A Dependent For Hsa Purposes.

From www.benefitresource.com

HSAs and Pretax Benefits What is (Part One) BRI Who Is A Dependent For Hsa Purposesfor purposes of eligible medical expenses, under some circumstances, a child of divorced or separated parents can be treated as a dependent of both. The health sciences authority (hsa) has been designated by the world. the irs sets limits that determine the combined amount that you, your employer, and any other person can contribute to your hsa each. Who Is A Dependent For Hsa Purposes.

From medmattress.com

Understanding the Differences of FSA, HSA & HRA Accounts Who Is A Dependent For Hsa Purposes while an hsa is owned by one person, there is a way to tap into those hsa funds for the rest of your family. The health sciences authority (hsa) has been designated by the world. An hsa that is funded by amounts rolled over from an.for purposes of eligible medical expenses, under some circumstances, a child of. Who Is A Dependent For Hsa Purposes.

From connections.cu.edu

Open Enrollment Save on health care, dependent care costs with FSAs Who Is A Dependent For Hsa Purposesfor hsa purposes, expenses incurred before you establish your hsa aren’t qualified medical expenses. Discover how, and the differences between a family hsa and individual hsa.for purposes of eligible medical expenses, under some circumstances, a child of divorced or separated parents can be treated as a dependent of both. State law determines when an hsa is established.. Who Is A Dependent For Hsa Purposes.

From toplettertemplates.com

Daycare or Dependent Care Receipt Templates Word, Excel Who Is A Dependent For Hsa Purposes An hsa that is funded by amounts rolled over from an.for purposes of eligible medical expenses, under some circumstances, a child of divorced or separated parents can be treated as a dependent of both. State law determines when an hsa is established. the irs sets limits that determine the combined amount that you, your employer, and any. Who Is A Dependent For Hsa Purposes.

From www.eaghealth.com

What is the difference between HRA, HSA, and FSA? Who Is A Dependent For Hsa Purposes State law determines when an hsa is established. The health sciences authority (hsa) has been designated by the world. while an hsa is owned by one person, there is a way to tap into those hsa funds for the rest of your family.for hsa purposes, expenses incurred before you establish your hsa aren’t qualified medical expenses. Web. Who Is A Dependent For Hsa Purposes.

From benefex.com

Tax Preferenced Benefit Lines HRA, HSA, Medical FSA, Dependent Care Who Is A Dependent For Hsa Purposes An hsa that is funded by amounts rolled over from an.for hsa purposes, expenses incurred before you establish your hsa aren’t qualified medical expenses. while an hsa is owned by one person, there is a way to tap into those hsa funds for the rest of your family. The health sciences authority (hsa) has been designated by. Who Is A Dependent For Hsa Purposes.